How to Short Cryptocurrency: Strategies, Tools, Risks, and Expert Tips

Key Takeaways

- Shorting crypto profits from price declines in bearish markets.

- Crypto markets are highly volatile, increasing risk and reward.

- Methods include margin trading, futures contracts, and options.

- Shorting can be done on major crypto exchanges.

- Leverage increases potential profits but also magnifies losses.

- Effective risk management is essential when shorting crypto.

- Regulatory changes may affect the future of shorting.

- Ethical concerns exist regarding market manipulation in shorting.

Shorting cryptocurrency has become a popular strategy. Traders can profit when crypto prices fall. However, it is a high-risk strategy. The volatile nature of cryptocurrencies adds complexity. This guide will help you understand the process of shorting crypto, strategies involved, and key tools. You will also learn about risks, ethics, and alternatives to shorting. By the end, you’ll be ready to make informed decisions.

What Is Shorting in Cryptocurrency?

Shorting cryptocurrency is betting that the price will drop. You borrow crypto from an exchange, sell it, and then aim to buy it back at a lower price. If the price falls, you profit from the difference. It’s a method used by traders when they expect a decline in market value.

In traditional finance, shorting stocks works the same way. You borrow stocks, sell them, and then repurchase them at a lower price. The concept of shorting in crypto is very similar. However, the main difference lies in the crypto market’s volatility. Cryptos often experience significant price swings, making shorting more risky but also rewarding.

The ability to short crypto allows traders to take advantage of market downturns. In the stock market, shorting is common in bear markets, and the same applies to crypto. This strategy allows traders to profit from price declines.

How Shorting Works in Traditional vs. Crypto Markets

| Feature | Shorting Crypto | Shorting Stocks |

| Asset Type | Digital currencies (e.g., Bitcoin) | Stocks, bonds, commodities |

| Platforms | Crypto exchanges (e.g., Binance, Kraken) | Stock brokers (e.g., E*TRADE) |

| Leverage | High leverage (up to 100x) | Limited leverage (usually lower) |

| Volatility | Very high | Lower volatility |

| Risk of Liquidation | High risk of liquidation | Lower risk of liquidation |

| Regulations | Less regulated | Heavily regulated |

A crypto trader might state, “I short Bitcoin when I think the price is going to drop.” This highlights the opportunity to profit from bear markets in cryptocurrency, just as in traditional assets.

The Basics of Short Selling

Short selling involves borrowing an asset to sell it, intending to buy it back at a lower price. Here’s how it works:

- Borrow the asset: You borrow cryptocurrency from an exchange or lender.

- Sell it: You sell the borrowed cryptocurrency at the current market price.

- Wait for a price drop: You wait for the market to fall.

- Buy back: If the price drops, you buy the crypto back at a lower price.

- Return it: You return the crypto to the lender and keep the difference as profit.

It’s like borrowing a book, selling it, and buying it back at a lower price. The difference between what you sold it for and what you bought it back for is your profit.

One of the benefits of shorting is that you don’t need to own the asset upfront. However, the risks are high — if the price rises, you can face large losses.

Why Do Investors Short Cryptocurrency?

Investors choose to short cryptocurrency for various reasons:

- Profit from market declines: Traders profit when they predict that crypto prices will drop.

- Hedging: Shorting can protect long positions from price downturns.

- Speculation: Traders use shorting as a speculative bet on price movements.

- Risk management: Shorting can offset losses in other parts of a portfolio.

- Leverage opportunities: High leverage allows traders to take bigger positions with less capital.

Shorting also offers a way to generate profits in a bear market, especially when long positions might be risky. However, it requires knowledge and skill to execute successfully.

Methods of Shorting Cryptocurrency

There are different methods available to short cryptocurrency. Let’s explore the most common ones:

Margin Trading

Margin trading lets you borrow funds to trade more than your own investment. In shorting, you borrow crypto from an exchange, sell it, and hope to buy it back at a lower price.

Pros and Cons of Margin Trading

| Pros | Cons |

| Potential for high profits: Leverage allows for large returns on small price movements. | Increased risk of liquidation: If the market moves against you, you may lose your collateral. |

| Flexibility with leverage: You can choose the leverage amount based on your risk appetite. | Requires collateral: To open a margin position, you need to deposit funds to secure the loan. |

| Access to larger positions: With borrowed funds, you can control a larger amount of crypto than your initial capital. | High fees: Borrowing funds on margin can incur interest fees, especially for long positions. |

Margin trading allows for greater exposure with limited capital but increases both the potential reward and the risk of liquidation.

Shorting Through Futures Contracts

Futures contracts let you agree to buy or sell an asset at a set price in the future. Traders short crypto by entering contracts where they agree to sell at today’s price, betting that the price will fall by the contract’s expiration.

Pros and Cons of Futures Contracts

| Pros | Cons |

| Leverage amplifies profits: You can control a large position with a relatively small investment. | Risk of liquidation: If the market moves in the opposite direction, your position can be liquidated. |

| No need to own the asset: You don’t need to hold the actual cryptocurrency to short it. | Complex to understand: Futures can be difficult for new traders due to the mechanisms involved. |

| Fixed expiration date: Futures have a clear timeline, helping to set precise profit-taking or exit points. | Market risk: The price might not move as expected within the contract’s timeframe, leading to potential losses. |

Futures contracts offer a powerful tool for shorting, but they can be complicated for new traders. Understanding how these contracts work is crucial to managing risks.

Options Trading: Puts for Shorting Crypto

Options trading involves buying a contract that gives you the right to buy or sell at a set price. A put option allows traders to profit from price declines by giving them the right to sell at today’s price.

Pros and Cons of Options Trading

| Pros | Cons |

| Limited risk (premium paid): The maximum loss is the premium you pay for the option. | Premium may be lost: If the price doesn’t decline as expected, the premium paid for the option expires worthless. |

| Flexible strategies: You can use puts in combination with other strategies like covered calls or spreads. | Expiry dates limit gains: Options come with a fixed expiration date, limiting how long you can hold the position. |

| Leverage opportunities: Options offer high leverage, enabling large returns from small price movements. | Complex to use: Options are complex and require a strong understanding of how they work. |

Options trading offers a way to limit your risk, but it requires a solid understanding of the options market to be effective.

Leveraged Tokens and Inverse ETFs

Leveraged tokens and inverse ETFs are financial products that allow you to short cryptocurrency without using margin or futures. These products are designed to profit when the price of crypto falls.

Pros and Cons of Leveraged Tokens and Inverse ETFs

| Pros | Cons |

| No borrowing required: These products don’t require you to borrow crypto or take on margin debt. | High volatility: These products can be extremely volatile, amplifying both potential gains and losses. |

| Passive shorting: They automatically track the price movement of the underlying asset, making them simpler to use. | Risky for long-term holding: Due to compounding effects and market volatility, they are generally suited for short-term trading. |

| Simple to use: Unlike margin trading or futures, these products are easy to access and don’t require complex trading strategies. | Fees and expenses: Leveraged tokens and inverse ETFs often come with higher fees than traditional investing. |

These tools simplify the shorting process, but they carry their own risks due to high volatility and market unpredictability.

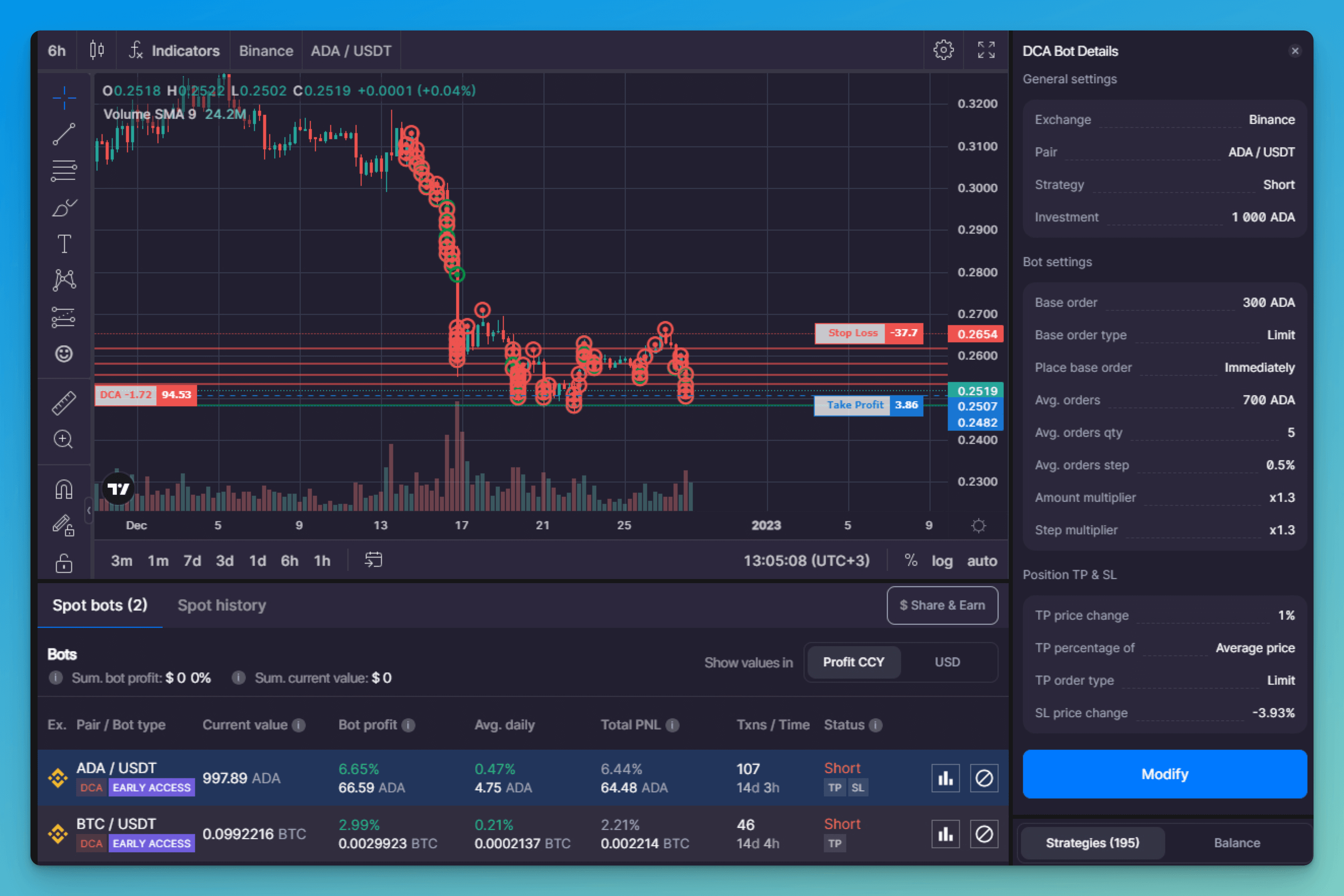

Platforms and Tools for Shorting Crypto

To short cryptocurrency, you need access to a platform that offers the necessary tools. Leading platforms provide margin trading, futures, and options for shorting.

| Platform | Leverage | Fees | Features | Overview |

| Binance | Up to 125x | Low | Margin trading, Futures, Options | Binance is one of the largest and most popular crypto exchanges globally. It offers high leverage, a variety of features, and low fees, making it suitable for experienced traders. However, the complexity and high leverage might not be ideal for beginners. |

| Kraken | Up to 5x | Medium | Margin trading, Futures | Known for its security and regulatory compliance, Kraken offers margin trading with lower leverage (up to 5x) and futures. It provides a safer environment with strong customer support, making it a good choice for beginners or conservative traders. |

| Bitfinex | Up to 3.3x | High | Margin trading, Lending | Bitfinex provides lower leverage (up to 3.3x) but offers advanced features such as lending. It has solid liquidity and is favored by professional traders. However, its higher fees and complex interface may not be suitable for new users. |

| Bybit | Up to 100x | Low | Margin trading, Futures, Options | Bybit offers high leverage (up to 100x) on both margin trading and futures. The platform is user-friendly, making it suitable for both beginners and experienced traders. Bybit is known for its low fees and strong customer support, making it a popular choice for shorting. |

| FTX | Up to 101x | Low | Margin trading, Futures, Options, Tokenized Stocks | FTX is a well-established exchange offering margin trading, futures, and options with leverage up to 101x. It has a strong reputation in the crypto space, with a wide range of products and competitive fees. Its advanced features may appeal to more experienced traders. |

| Huobi Global | Up to 5x | Medium | Margin trading, Futures, Options | Huobi Global is a popular exchange offering leverage up to 5x for margin trading and futures. Known for its global reach and diverse range of cryptocurrencies, Huobi is an accessible platform for both beginners and seasoned traders looking to short crypto assets. |

Key Considerations for Choosing a Platform

When selecting a platform for shorting cryptocurrency, consider the following factors:

- Leverage Options: Platforms offer varying levels of leverage. Higher leverage (like Binance’s 125x) increases potential profits, but also significantly raises the risk of liquidation.

- Fees: Look for platforms with low fees on trades, margin borrowing, and withdrawals. High fees can eat into your profits.

- Liquidity: Higher liquidity on a platform ensures smoother execution of trades, minimizing slippage, and improving order execution.

- Security and Regulation: Ensure the platform is secure and follows regulatory guidelines. Some exchanges are more compliant with local financial authorities, offering an added layer of protection for users.

- Educational Resources: For beginners, it’s helpful to use platforms that offer tutorials, guides, and customer support to navigate the complexities of shorting and trading.

Risks and Challenges of Shorting Crypto

Shorting crypto carries high risks due to the market’s unpredictability. Here are some of the biggest challenges:

Volatility

Crypto prices are known for their extreme volatility, which means they can swing wildly in short periods. Even small market events or news can cause massive price fluctuations, making it difficult to predict the direction of the market. Traders who short crypto are particularly vulnerable to sudden price increases.

Liquidation Risk

When using leverage to short crypto, there is a risk of liquidation. If the market moves against your position (i.e., prices rise instead of fall), your leveraged position can quickly become unprofitable. If the value of your position falls below a certain threshold, your collateral may be liquidated to cover the losses, causing you to lose your initial investment.

Margin Calls

Margin trading requires you to maintain a minimum balance in your account, often referred to as the maintenance margin. If the market moves against you and the value of your short position decreases, the exchange may issue a margin call, requiring you to add more funds to your account to keep your position open. If you cannot meet the margin call, your position could be liquidated.

Regulatory Concerns

The cryptocurrency market is still relatively under-regulated compared to traditional financial markets. This creates uncertainty for traders, especially when it comes to the legalities of shorting or borrowing assets. Regulatory changes or crackdowns on exchanges can lead to sudden market disruptions, affecting the stability of your short position.

Strategies for Successful Crypto Shorting

To be successful at shorting crypto, consider the following strategies:

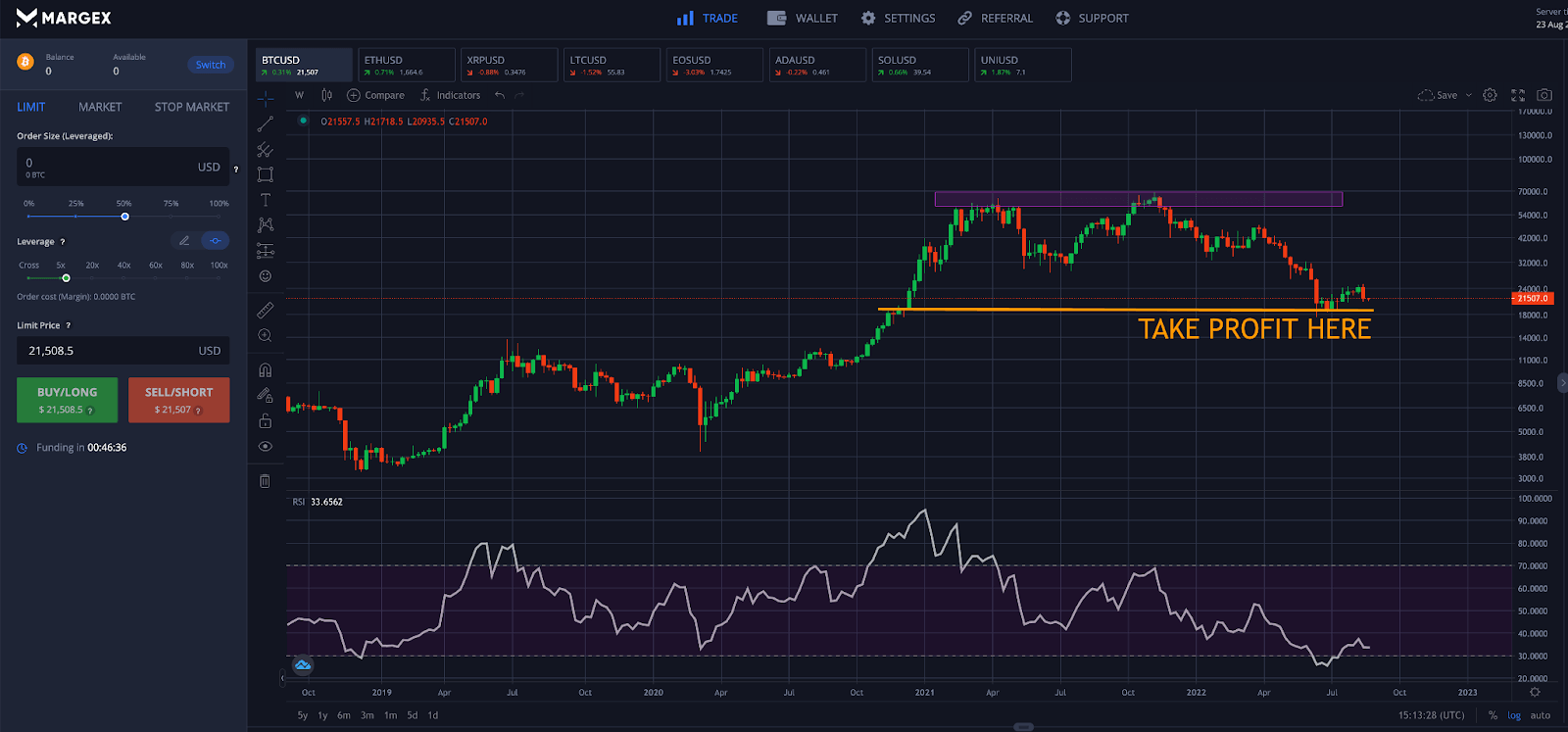

Technical Analysis

Technical analysis involves using historical price data, charts, and indicators to predict future market movements. By analyzing price trends, support and resistance levels, and key indicators (like RSI, MACD, and moving averages), you can identify potential entry and exit points for shorting.

Example: If a cryptocurrency is showing signs of overbought conditions (e.g., high RSI), it may be due for a correction, making it a good shorting opportunity.

Stop-Loss Orders

A stop-loss order is an essential risk management tool that automatically closes your position if the market moves against you. By setting a stop-loss, you limit potential losses and prevent your position from being liquidated due to unfavorable price movements.

Example: If you short a crypto at $20,000, setting a stop-loss at $22,000 helps ensure that if the price rises unexpectedly, your position will be closed to prevent large losses.

Market Sentiment

Staying informed about market sentiment and news that affects the crypto market is crucial when shorting. Positive news or macroeconomic factors can trigger sudden price increases, while negative news (like regulatory crackdowns or security breaches) can lead to sharp declines.

Example: A tweet from a major crypto influencer or government regulations can drastically impact price movements, so keeping up with the latest developments can help you avoid being caught in an unpredictable market swing.

Diversification

While shorting a single cryptocurrency can be profitable, it also carries significant risks. Diversifying across multiple assets helps to hedge against risks. By shorting different cryptocurrencies or using other risk management tools like stablecoins, you reduce the likelihood that a sudden market shift in one asset will lead to large losses.

Example: If you’re shorting Bitcoin, Ethereum, and Binance Coin, you’re not relying on a single asset’s price movement. If one position moves against you, the other positions can help offset the loss.

Practical Example: How to Short a Cryptocurrency

Let’s say you believe Bitcoin will drop in price. Here’s a step-by-step guide on how you can short Bitcoin.

| Step | Action | Details | Example/Outcome |

| 1. Open a Margin Account | Sign up for a platform that supports margin trading (e.g., Binance). | Create an account and open a margin account to borrow funds for trading. | Open a margin account on Binance to start margin trading. |

| 2. Borrow Bitcoin from the Exchange | Borrow Bitcoin to short it. | Check borrowing options and fees. | Borrow 1 BTC at $30,000. |

| 3. Sell Bitcoin at Current Price | Sell the borrowed Bitcoin at the current market price. | You sell the Bitcoin you borrowed at the market price to open your short position. | Sell 1 BTC at $30,000. |

| 4. Wait for Price Drop | Monitor the market and wait for the price to fall. | If the price drops, your short position becomes profitable. | Wait for Bitcoin to drop to $25,000. |

| 5. Buy Bitcoin Back and Return It | Buy Bitcoin back at the lower price and return the borrowed Bitcoin. | After the price drops, buy back the same amount of Bitcoin to close the position. | Buy back 1 BTC at $25,000 and return it to the platform. |

| 6. Calculate Your Profit | Calculate your profit (selling price – buying price) minus any borrowing fees. | Profit is the difference between the sell and buy price, less any fees. | Profit = $30,000 – $25,000 = $5,000 (befo |

The Ethics and Impact of Shorting Crypto

Shorting cryptocurrency can be a controversial topic in the financial world. While some view it as an essential mechanism for market efficiency, others argue that it can contribute to market instability. Here’s a closer look at the ethical considerations and the impact of shorting crypto:

Market Instability vs. Market Efficiency

Market Instability: Critics of shorting often argue that it can create unnecessary volatility and exacerbate market downturns. When large volumes of crypto are shorted, it can trigger a self-fulfilling prophecy, where prices fall due to widespread shorting activity, even if the market conditions don’t justify such a drastic drop. This can cause panic selling and lead to greater market instability.

Market Efficiency: On the other hand, proponents of shorting argue that it’s an important tool for market efficiency. Short selling allows traders to bet on price declines, which can help correct overinflated asset values. In essence, shorting forces the market to reflect the true value of an asset, making it harder for bubbles to form. By enabling traders to profit from falling prices, shorting helps identify and address overvalued cryptocurrencies.

https://www.steel-eye.com/hubfs/SteelEye-Market Manipulation Price Ramping (2).png

Market Manipulation Risks

One of the significant ethical concerns around shorting is the potential for market manipulation. Traders or groups of traders may intentionally spread negative news or rumors to cause panic and drive prices down, allowing them to profit from short positions. This type of manipulation can be harmful to retail investors and undermine the integrity of the market.

Example: A well-timed, negative headline about a cryptocurrency project could cause a sharp price drop, which a group of short sellers could exploit to make a profit. This raises questions about fairness and transparency in the market.

Exposing Overvalued Assets

Despite these ethical concerns, shorting can play a positive role in exposing overvalued assets. In the crypto market, where hype and speculation can cause inflated prices, short selling helps maintain a market balance by correcting inflated valuations.

Example: If a cryptocurrency project is based on unrealistic promises or lacks fundamental backing, shorting can help bring the price down to a more reasonable level, encouraging investors to be more cautious and research-driven.

Alternatives to Shorting Cryptocurrency

If you want to reduce risk without engaging in shorting, there are several alternative strategies to consider. These methods can help you navigate the crypto market more safely, avoiding the complexities and risks associated with shorting.

Stablecoins

Investing in stablecoins is one of the safest ways to avoid the extreme volatility often seen in the crypto market. Stablecoins are digital assets pegged to fiat currencies like the U.S. dollar, which helps maintain a stable value.

Example: By holding stablecoins like USDT (Tether), USDC (USD Coin), or DAI, you can avoid the price fluctuations of more volatile cryptocurrencies like Bitcoin or Ethereum, while still participating in the crypto ecosystem.

Diversification

Diversification involves spreading your investments across a variety of cryptocurrencies, rather than focusing on just one. This strategy helps reduce risk because the performance of one asset won’t have as large an impact on your overall portfolio.

Example: Instead of investing all your funds in Bitcoin, you could diversify by also holding Ethereum, Solana, Polkadot, or other promising altcoins. This way, if one cryptocurrency suffers a price drop, the others in your portfolio might perform better, balancing out potential losses.

Hedging

Hedging is a strategy that involves using financial instruments like crypto derivatives (options, futures, or other contracts) to protect your portfolio against adverse price movements.

Example: If you hold a large amount of Bitcoin and are concerned about a potential price decline, you can use Bitcoin futures contracts to lock in a selling price or buy put options to benefit from a price drop without directly shorting the asset. This way, you can hedge against downside risk while still holding onto your assets.

Long-Term Investing

Long-term investing (also known as HODLing) is a strategy where you hold assets through market cycles, rather than actively trading. This method allows you to avoid the stress and complexity of shorting or making quick market calls. By focusing on long-term growth, you can ride out market volatility and capture potential future gains.

Example: If you believe in the long-term potential of Bitcoin or Ethereum, holding these assets through market dips and upswings can be a safer bet than attempting to time the market with shorting.

The Future of Shorting in the Crypto Market

The future of shorting cryptocurrency is set to evolve with the maturation of the crypto market. As more institutional players and retail traders enter the space, and as regulatory frameworks become clearer, the tools and strategies for shorting will become more sophisticated and regulated. Here’s a closer look at what the future might hold:

Increased Regulation and Clearer Rules

As the cryptocurrency market matures, governments and financial regulators around the world will likely introduce more comprehensive regulations specifically targeting shorting and other trading activities.

The impact of increased regulation on the crypto market will likely provide greater protection for traders and create a more level playing field. Regulatory clarity could introduce rules to prevent market manipulation, enforce transparency in shorting activities, and ensure exchanges comply with local laws, leading to more structured environments for shorting, similar to traditional financial markets. Additionally, stricter compliance and reporting standards will help exchanges prevent fraud and manipulation, benefiting traders with better transparency and enhanced protection.

Advanced Risk Management Tools

The future of shorting will likely see the development of more advanced risk management tools that make shorting crypto safer and more accessible, even for less experienced traders.

As the crypto market matures, platforms are likely to offer more flexible leverage options, along with enhanced risk management tools such as real-time alerts, automated stop-loss orders, and liquidation protection. These features will help traders better manage their exposure and reduce risks. Additionally, insurance products may be introduced to protect traders from extreme market fluctuations, reducing the likelihood of catastrophic losses during volatile periods. This could make shorting cryptocurrencies a more viable and attractive option for mainstream traders.

Increased Demand for Shorting Tools

Despite the inherent risks, the demand for shorting tools is expected to grow as more traders and institutions enter the crypto market.

As the crypto market matures, traders will seek more opportunities to profit from both rising and falling prices, making shorting tools like margin trading, futures contracts, and options increasingly popular for hedging against potential downturns. With the growth of institutional participation in the crypto space, there will likely be greater demand for more regulated and robust shorting tools, including customized derivatives and other financial instruments. These tools will cater to large-scale shorting strategies, helping institutional investors navigate the complexities of the crypto market while managing risk more effectively.

Potential for More Diverse Shorting Instruments

As the crypto market evolves, we may see more diverse financial instruments for shorting crypto. These could include inverse ETFs, synthetic assets, and more flexible futures and options contracts tailored to different market conditions.

Example: More products designed to profit from market declines, such as inverse crypto ETFs (which rise in value when the price of a crypto asset falls), might emerge, making shorting more accessible to retail investors who prefer passive strategies.

What is shorting cryptocurrency?

Shorting crypto means borrowing and selling a coin to buy it back later at a lower price. Traders profit from price drops.

What are the risks of shorting crypto?

The risks include high volatility, liquidation, margin calls, and regulatory uncertainties.

Can you make money by shorting crypto?

Yes, if the price of the cryptocurrency drops after you sell it. However, it’s risky, and prices can rise unexpectedly.

What platforms allow you to short crypto?

Platforms like Binance, Kraken, and Bitfinex allow you to short cryptocurrencies with margin, futures, and options.

Is shorting crypto legal?

Shorting is legal on most exchanges, but regulations vary by country and platform.

How can I reduce risks when shorting crypto?

Use risk management tools like stop-loss orders, and stay informed about market trends and news.