Mastering Crypto Market Cycles: How to Predict Patterns and Invest Smarter

Key Takeaways

- Crypto market cycles influence price fluctuations.

- The market goes through four phases.

- Supply, demand, and sentiment affect cycles.

- Bitcoin halving impacts market cycles and prices.

- Technical indicators help identify market trends.

- Seasonality influences crypto prices and investor behavior.

- Risk management is crucial during market cycles.

- Future developments may reshape market cycles.

Understanding crypto market cycles is key to making smarter investment decisions. This guide explores market patterns and offers strategies to predict price trends, manage risks, and maximize profits.

Understanding Crypto Market Cycles

Crypto market cycles are patterns that describe the rise and fall of cryptocurrency prices over time. These cycles help investors predict trends, anticipate volatility, and understand market psychology. Just like in traditional financial markets, crypto markets go through stages of growth, stability, and decline. Understanding these cycles gives investors an edge, helping them make smarter, more informed decisions. Timing your trades can be the difference between massive profits or heavy losses.

Why Crypto Markets Move in Cycles

Cryptocurrency markets are notoriously volatile, swinging wildly between bullish and bearish phases. According to recent data, Bitcoin alone has experienced price swings of over 30% in a single month. Crypto prices don’t just rise indefinitely — they always pull back. As crypto expert Andreas M. Antonopoulos puts it, “The market doesn’t go up forever. It has to come down eventually.” Understanding when to buy and sell is crucial to success in such an unpredictable environment.

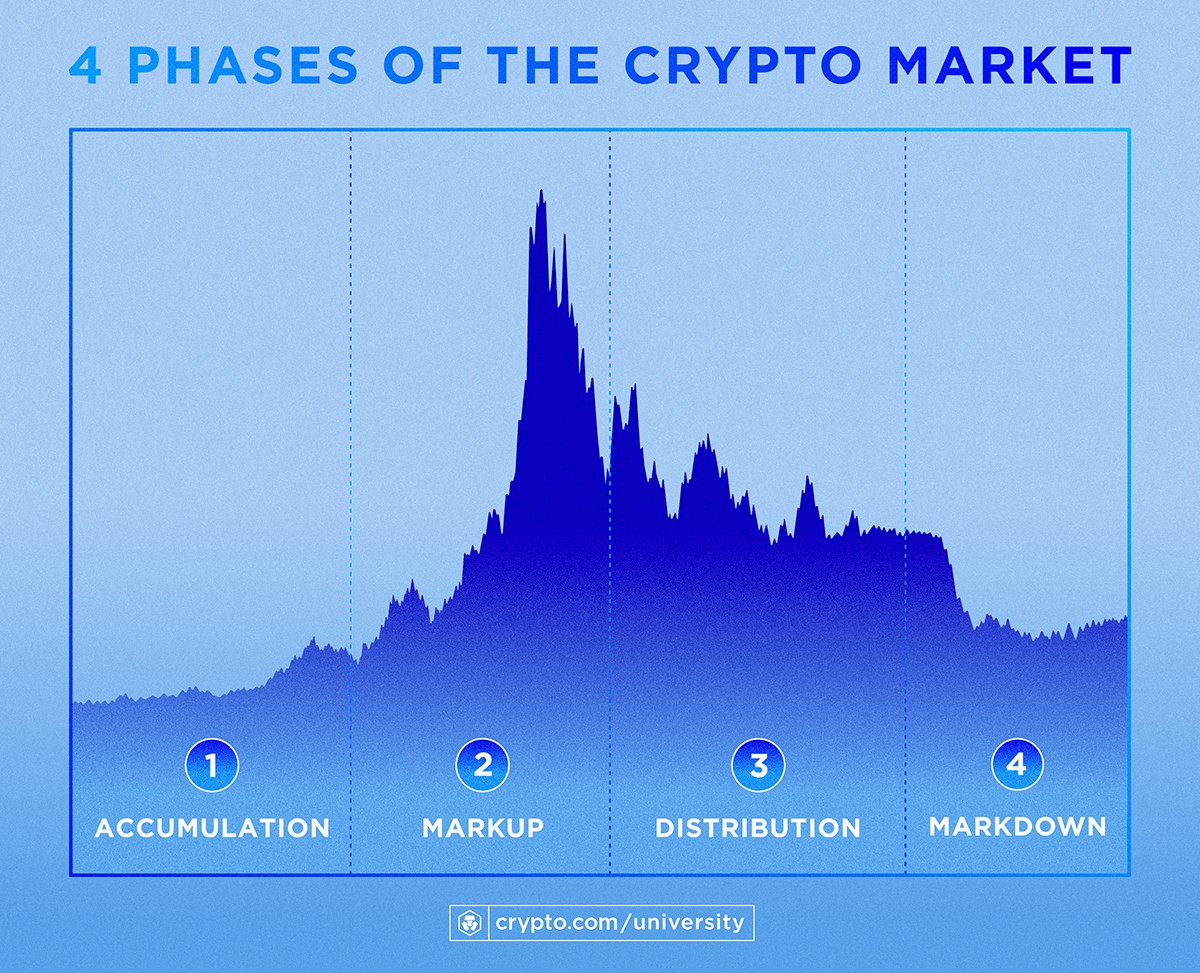

Four Phases of Crypto Market Cycles

Crypto market cycles can be broken down into four distinct phases: accumulation, uptrend, distribution, and downtrend. Each phase reveals how prices react to changes in market sentiment, supply and demand, and broader economic conditions. Knowing how these phases work helps investors avoid buying during market peaks or selling during market dips.

Accumulation: Prices Are Stable After a Downturn

This phase occurs after a significant price drop. Sentiment is low, and many investors are hesitant to enter the market. However, the experienced investor sees opportunity. Prices remain relatively flat, and seasoned traders begin accumulating coins, anticipating a future rise. Historically, the accumulation phase has led to huge gains for early buyers, as seen in Bitcoin’s price action in 2018-2019.

Uptrend: Prices Rise as Demand Increases

As the market begins to recover, prices start to rise. This phase is fueled by speculation, increasing demand, and a shift in market sentiment. News, technological advancements, and institutional investments can trigger this phase.

During Bitcoin’s 2024 bull run, for example, we saw a rise from $16,000 to over $100,000 in December, driven by institutional adoption, the launch of Bitcoin ETFs, and a surge in demand for blockchain-based financial solutions.

Distribution: Early Investors Start Selling Their Assets

In the distribution phase, prices have peaked, and early investors look to lock in profits. The market begins to show signs of overheating, with prices reaching unsustainable levels. During this phase, you’ll often see increased trading volume as whales (big investors) start unloading their positions. In the 2021-2022 market, many retail investors saw a massive crash coming as Bitcoin hit its all-time high, only to drop more than 50% shortly afterward.

Downtrend: Prices Drop as Supply Outpaces Demand

As the market becomes oversaturated with sell orders, the downtrend begins. Fear and panic take over, and many investors sell out of fear of further losses. This phase can be sharp and brutal, often leading to sharp corrections or even crashes. In 2022, Bitcoin’s price fell from its peak of $69,000 to around $16,000, triggering widespread panic selling. But savvy investors who bought during these lows were poised for recovery when the market eventually rebounded.

Why Understanding Market Cycles is Crucial for Crypto Investors

Crypto market cycles are essential for managing risk and maximizing profits. Knowing when a market is in a peak or trough allows investors to time their trades more effectively. Take Bitcoin’s explosive run in 2017. As the market entered the uptrend phase, Bitcoin surged to nearly $20,000 in December, creating a frenzy among retail investors. However, just months later, Bitcoin’s price plummeted, causing heavy losses for those who bought in too late. Identifying market cycles could have helped those investors avoid the worst of the crash.

Understanding the Phases in Traditional vs. Crypto Markets

Traditional markets, like stocks, are largely driven by macroeconomic factors such as inflation, interest rates, and corporate performance. Crypto markets, on the other hand, are heavily influenced by speculation, technological advancements, and supply factors.

| Phase | Traditional Market | Crypto Market |

| Accumulation | Investor confidence dips | Investors accumulate after a crash |

| Uptrend | Economic recovery | Speculation and demand push prices |

| Distribution | Profit-taking | Early investors cash out |

| Downtrend | Market correction | Panic selling and crash |

How to Navigate the Crypto Market Cycle

Understanding market cycles isn’t just about theory — it’s about applying that knowledge in real-time. Every phase offers unique opportunities, but also risks. For instance, during an accumulation phase, while prices are low, buying can set you up for a significant profit in the uptrend. On the flip side, buying during a distribution phase can result in losses as prices start to fall.

Timing is Everything

The most successful crypto investors are those who can read the signs of each phase and act accordingly. Successful timing could mean catching the early part of an uptrend, avoiding the panic selling of a downtrend, or capitalizing on the accumulation phase. While no one can predict exact price movements, understanding the phases of a cycle dramatically improves your chances of success.

Key Drivers Behind Crypto Market Cycles

Crypto market cycles are influenced by factors like supply and demand, speculation, investor sentiment, and external events such as Bitcoin halving. These factors drive price movements of Bitcoin and other cryptocurrencies, creating both opportunities and risks for investors. Understanding these forces is essential for making informed decisions in the volatile crypto world.

Supply and Demand in the Crypto Market

The law of supply and demand is central to crypto price movements. When demand for a cryptocurrency rises while supply remains limited, prices typically increase. Conversely, when supply exceeds demand, prices tend to fall. This basic principle drives much of the volatility in crypto markets.

Limited Supply: Fixed Caps and Tokenomics

Many cryptocurrencies, like Bitcoin, have fixed supply caps, which affect their scarcity and value. Bitcoin’s maximum supply is capped at 21 million coins, making it scarce and similar to gold in value. Other cryptocurrencies, such as Ethereum, also incorporate scarcity, though Ethereum’s supply model is more flexible, with its transition to proof-of-stake (Ethereum 2.0) making it more deflationary over time.

Token Burns: A Tool for Reducing Supply

Token burns, where a cryptocurrency deliberately destroys some of its tokens to reduce supply, can drive price increases due to the scarcity effect. For example, Binance Coin (BNB) has periodic burns that reduce supply and often lead to price surges. BNB’s price surged in 2024 following a significant burn event, spurring bullish sentiment.

Macro Events: Regulation and Liquidity

Crypto prices are also affected by macroeconomic events, such as regulatory changes, global financial instability, and shifts in liquidity. Regulatory news, especially from major markets like the US, EU, and China, can cause sharp price movements. For instance, when the SEC filed lawsuits against major exchanges in 2023, Bitcoin’s price dropped by over 10%, reflecting market uncertainty. Liquidity also plays a critical role — during market crashes, a lack of liquidity can exacerbate downturns and make assets harder to sell.

Bitcoin Halving and Its Role in Market Cycles

Bitcoin halving is a key event in crypto market cycles. Occurring every four years, it cuts in half the reward miners receive for validating Bitcoin transactions, reducing the supply of new Bitcoin. This scarcity effect often leads to price increases if demand remains strong. Historically, Bitcoin has seen significant price increases after halving events.

Sentiment and Speculation: How Psychology Impacts Cycles

Investor sentiment plays a major role in shaping crypto market cycles. Unlike traditional markets, crypto markets are heavily influenced by emotions. Greed, fear, and the fear of missing out (FOMO) can drive prices up during bull markets, while panic can lead to sharp declines during bear markets. In bull markets, FOMO leads to surges in demand, pushing prices higher. In bear markets, fear and panic selling can cause significant price drops.

Speculation: The Wild Card

Speculation is a major driver in crypto markets. Many investors hope to profit from short-term price movements rather than long-term fundamentals. Emerging technologies, such as Layer 2 solutions and AI-driven crypto projects, often spark speculative price pumps, which can lead to bull runs or crashes when hype fades. Sentiment analysis — tracking social media trends and market indicators — can help investors gauge the overall market mood, especially during volatile periods.

https://assets.staticimg.com/reaper-image/6735d204502da10001bb982c_What Is a Bitcoin ETF_ Everything You Need to Know.png

Patterns and Indicators in Crypto Market Cycles

Identifying patterns in crypto market cycles is crucial for investment decisions. Recognizing recurring trends helps traders predict price movements, understand sentiment, and time entries and exits. Technical indicators like RSI, Moving Averages, and MACD offer valuable market insights.

Identifying Bull and Bear Markets

A bull market features rising prices and investor confidence. During this phase, demand exceeds supply, pushing prices upward. A bear market is marked by falling prices, negative sentiment, and investor fear, often triggered by declining demand or broader economic factors.

| Characteristic | Bull Market | Bear Market |

| Prices | Sustained price increases | Continuous price declines |

| Demand | High demand exceeding supply | Decreased demand due to fear |

| Investor Sentiment | Positive news and uncertainty create optimism | Negative news triggers panic selling |

| Volume | Increased trading volume, strong market momentum | Decreased trading volume, lower activity |

Common Technical Indicators for Market Cycles

Traders use various technical indicators to analyze market trends and time trades.

| Indicator | Description | Interpretation |

| RSI (Relative Strength Index) | Measures speed and change of price movements, identifying overbought or oversold conditions. | – RSI > 70: Overbought, potential pullback.

– RSI < 30: Oversold, potential buying opportunity. |

| MACD (Moving Average Convergence Divergence) | Identifies momentum changes and trend reversals by comparing 12-day and 26-day EMAs. | – MACD crosses above signal line: Bullish momentum.

– MACD crosses below signal line: Bearish momentum. |

| Bollinger Bands | Measures market volatility using a moving average and adjustable bands. | – Price near upper band: Overbought, potential pullback.

– Price near lower band: Oversold, potential buying opportunity. |

Historical Examples of Market Cycle Patterns

Studying past cycles helps predict future market behavior. Here’s the table capturing Bitcoin’s major bull and bear markets, updated to include 2024:

| Period | Price Movement | Key Drivers | Outcome |

| 2017 Bull Run | $1,000 → $20,000 | High demand, optimism, media coverage | Peak in December 2017 |

| 2018 Bear Market | $20,000 → $3,000 | Panic selling, regulatory uncertainty | Major crash |

| 2020-2021 Bull Run | $8,000 → $60,000 | Institutional adoption, DeFi growth, pandemic uncertainty | Peak in April 2021 |

| 2022 Bear Market | $60,000 → $20,000 | Rising interest rates, market correction | Stabilized by late 2022 |

| 2024 Bull Run | $16,000 → $100,000+ | Bitcoin ETFs, institutional adoption, blockchain demand | Record high in December 2024 |

Each bull and bear market highlights the volatility of Bitcoin, underscoring the influence of external factors like regulatory changes, economic conditions, and technological advancements.

Seasonal Trends in Crypto Investing

Does Seasonality Affect the Crypto Market? Yes, seasonality affects crypto markets, much like traditional financial markets. Crypto prices often follow time-based patterns. For example, tax season can lead to sell-offs as investors liquidate assets. Conversely, end-of-year periods, like Q4, often see rallies due to optimism and holiday spending.

Monthly and Quarterly Trends in Crypto Prices

Crypto markets show consistent monthly and quarterly patterns that guide investor decisions. Here is a summary of the Monthly and Quarterly Trends in the crypto market:

| Time Period | Trend Description |

| Monthly Trends | |

| January and February | Price declines or low volatility due to tax-related sell-offs or portfolio adjustments post-holidays. |

| March and April | Market recovery often begins, driven by fresh capital inflows and settled tax obligations. |

| November and December | Historically stronger performance due to year-end rallies, institutional investments, and tax-loss harvesting. |

| Quarterly Trends | |

| Q1 (January to March) | Prices typically drop or remain flat due to post-holiday profit-taking and tax season sell-offs. |

| Q2 (April to June) | Prices often rise as investor sentiment stabilizes, with increased institutional interest and new developments. |

| Q3 (July to September) | Weaker performance, with lower volumes and slight price corrections, often due to summer cash-outs. |

| Q4 (October to December) | Usually sees rallies, especially after Bitcoin halvings, with tax-related strategies and increased investor activity pushing prices higher. |

The Role of Macroeconomic Events in Seasonal Cycles

Macroeconomic events like inflation, interest rates, and regulatory changes significantly impact crypto price trends.

Inflation and Interest Rates

- Inflation: Rising inflation makes traditional assets like bonds less attractive, prompting investors to seek alternatives such as Bitcoin, which is seen as a hedge. As inflation increases, demand for cryptocurrencies grows, driving prices up.

- Interest Rates: Higher interest rates reduce liquidity and risk appetite, making cryptocurrencies less attractive. However, dovish policies or rate cuts can fuel bullish sentiment in crypto markets.

Regulatory Changes

Regulatory news plays a crucial role in shaping crypto market trends. Positive regulatory developments, like Bitcoin ETF approval or crypto-friendly policies, often lead to price surges. Conversely, negative regulatory news, such as potential crackdowns, can trigger price corrections due to increased fear of stricter controls.

Strategies for Navigating Crypto Market Cycles

Navigating the volatile crypto market requires smart strategies to manage risk and maximize returns. Depending on your goals, you can choose from strategies like dollar-cost averaging (DCA), holding (HODLing), or active trading. Each has its own benefits, depending on the market conditions and your investment objectives.

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging (DCA) is a popular and safe strategy, ideal for those seeking long-term growth. With DCA, you invest a fixed amount at regular intervals, regardless of price, helping reduce the risks of market timing.

How It Works

Rather than investing a lump sum, you spread your investments over time. This means buying more when prices dip and less when they rise, averaging out the cost per unit.

Benefits of DCA

- Reduced risk: DCA minimizes the risk of trying to time market peaks and dips.

- Consistent exposure: You stay invested without worrying about short-term fluctuations.

- Lower stress: DCA avoids the emotional rollercoaster that comes with market timing.

Real-World Example

During the 2020-2021 Bitcoin bull run, DCA investors likely bought at lower average prices than those who tried to time the market. Bitcoin later peaked at over $60,000, rewarding consistent investors.

Holding Strategy (HODLing)

HODLing means holding onto assets for the long term, regardless of price fluctuations. This strategy works best during bull markets when the overall trend is upward.

How It Works

You purchase an asset and hold it, trusting that it will increase in value over time, even if short-term dips occur.

Benefits of HODLing

- Long-term growth: Ideal for those who believe in the future value of crypto.

- Lower fees: Fewer trades mean lower transaction costs and taxes on short-term gains.

- Simplicity: It’s a passive “set it and forget it” strategy.

Risks of HODLing

- Missed opportunities: In prolonged downturns, you might miss the chance to sell during higher phases.

- Volatility: During bear markets, you endure significant price drops, which can be emotionally taxing.

If you’re looking to implement these strategies, consider opening an account on a reputable exchange like Bybit. Bybit offers advanced trading tools, competitive fees and a user-friendly interface perfect for both beginners and experienced traders.

Active Trading

Active trading involves buying and selling assets frequently to capitalize on short-term price fluctuations. This strategy requires careful market analysis and quick decision-making.

How It Works

Active traders use technical analysis, such as RSI, MACD, and Bollinger Bands, to predict price movements and enter or exit the market at favorable times. For example, a trader might buy Bitcoin after a 5% drop and sell after a 10% rise.

Benefits of Active Trading

- High returns: Traders can profit from small price movements over time.

- Flexibility: Active traders can profit in both bull and bear markets, even shorting assets.

- Leverage: Using leverage can amplify profits (though it increases risk).

Risks of Active Trading

- High risk: The fast-paced nature of active trading can lead to significant losses.

- Emotional stress: Constant monitoring and decision-making can cause burnout and impulsive decisions.

- Transaction costs: Frequent buying and selling lead to higher transaction fees, reducing profits.

The Future of Crypto Market Cycles

As cryptocurrencies gain mainstream adoption, the dynamics of market cycles are evolving. Institutional adoption, regulatory clarity, and technological innovations are key factors that could reshape these cycles. While crypto markets have long been known for extreme volatility, some experts predict greater stability in the future — though volatility may not disappear entirely.

Institutional Adoption and Its Impact

Institutional adoption is one of the most influential factors shaping future crypto market cycles. Big institutions like Tesla, MicroStrategy, and BlackRock have made substantial investments in Bitcoin, signaling a shift from retail to institutional investors. This shift could have several key impacts:

- Increased Liquidity: Institutional involvement improves liquidity, potentially reducing volatility. Larger trading volumes can help smooth out extreme price swings.

- Market Maturity: Institutions typically bring a long-term, calculated approach, reducing the speculative hype that has often caused erratic price movements.

- Strategic Products: Institutional-grade products like Bitcoin ETFs and crypto futures can bring in investors who want to hedge or diversify rather than hold crypto directly, adding stability.

- Counteracting Panic Selling: Institutions tend to avoid panic selling, which is common among retail investors. Their presence may help reduce extreme market crashes.

Real-World Example

In 2020-2021, companies like Tesla and Square made major Bitcoin investments, signaling growing institutional confidence. This shift contributed to both price increases and more market stability over time.

Regulation and Its Potential to Shape Market Cycles

Regulation is another critical factor for the future of crypto markets. As governments establish clearer rules, market cycles could change:

- Legal Clarity: Clearer regulations could reduce the uncertainty that triggers wild price swings, providing more confidence to investors.

- Investor Confidence: Regulations could attract traditional investors, such as pension funds and hedge funds, which often have longer-term investment horizons and less emotional involvement than retail investors.

- Consumer Protection: Regulatory frameworks could reduce fraud and market manipulation, leading to a more stable market environment.

However, regulation will vary by region. While countries like El Salvador have adopted progressive crypto laws, others like China have imposed strict restrictions. Regulatory uncertainty in major markets like the U.S. could present challenges, but as global regulations evolve, the market may move from speculative-driven volatility to more predictable cycles.

Real-World Example

The U.S. SEC began clarifying its stance on crypto in 2020, and Canada introduced Bitcoin ETFs in 2021. This regulatory progress has allowed institutional investors to enter the market, contributing to more stability.

New Technologies and Their Role in Shaping Cycles

Technological advancements are also influencing crypto market cycles, particularly blockchain scalability, interoperability, and the rise of decentralized applications (dApps):

- Scalability Solutions: Ethereum 2.0 and Layer 2 solutions like Polygon aim to improve transaction speeds and reduce fees. This could make crypto more practical for everyday use, reducing the impact of congestion and enhancing stability.

- Interoperability: Blockchain platforms that enable communication between different cryptocurrencies could reduce market fragmentation and erratic price movements across assets.

- NFTs and Web3: The growth of NFTs and Web3 applications could bring new market cycles, driven by a different type of investor. This diversification could stabilize the market by reducing the focus on Bitcoin and Ethereum alone.

- Stablecoins: Stablecoins (cryptocurrencies pegged to fiat currencies) could reduce volatility by providing a more stable asset class during times of market downturns.

Real-World Example

The launch of Ethereum 2.0 in 2022 promised greater scalability and lower transaction fees, making the network more user-friendly. Additionally, the rise of NFTs in art and gaming sectors in 2021 created new cycles that influenced crypto prices in unexpected ways.

Predictions for Less Volatility

Some experts believe that, with institutional adoption and technological maturity, crypto markets could experience less volatility in the future. For example, Bitcoin’s price has become less erratic as institutional buying and clearer regulations have stabilized the market. If this trend continues, market cycles could shift from speculative-driven booms and busts to more stable cycles based on long-term economic factors and technological progress.

However, it’s important to note that crypto is still a new, decentralized asset class, and volatility may never fully disappear. While we may see less frequent or extreme price swings, rapid growth and sharp corrections could still occur, especially as new developments in blockchain technology or global economics influence the market.

What are crypto market cycles?

Crypto market cycles refer to the recurring phases of rising and falling prices. They consist of four main phases: accumulation, uptrend, distribution, and downtrend.

Why are market cycles important for crypto investors?

Understanding market cycles helps investors predict price movements, avoid losses, and make informed decisions. It also enables better risk management and profit maximization.

How do I identify bull and bear markets?

Bull markets are characterized by rising prices and optimism. Bear markets have declining prices and negative sentiment. Key indicators like RSI and MACD help spot these trends.

Does Bitcoin halving affect market cycles?

Yes, Bitcoin halving reduces mining rewards and limits supply, often driving up demand and price. Historical halving events have seen significant price increases.

Can seasonality impact crypto prices?

Yes, seasonal trends like tax deadlines or year-end rallies influence market behavior. Q4 often sees price increases due to holiday and tax-related activities.

What strategies can I use to navigate market cycles?

Common strategies include dollar-cost averaging, holding for long-term gains, or active trading to profit from short-term price movements.