NFT Marketplaces in 2024: How to Choose the Best Platform for Buying and Selling NFTs

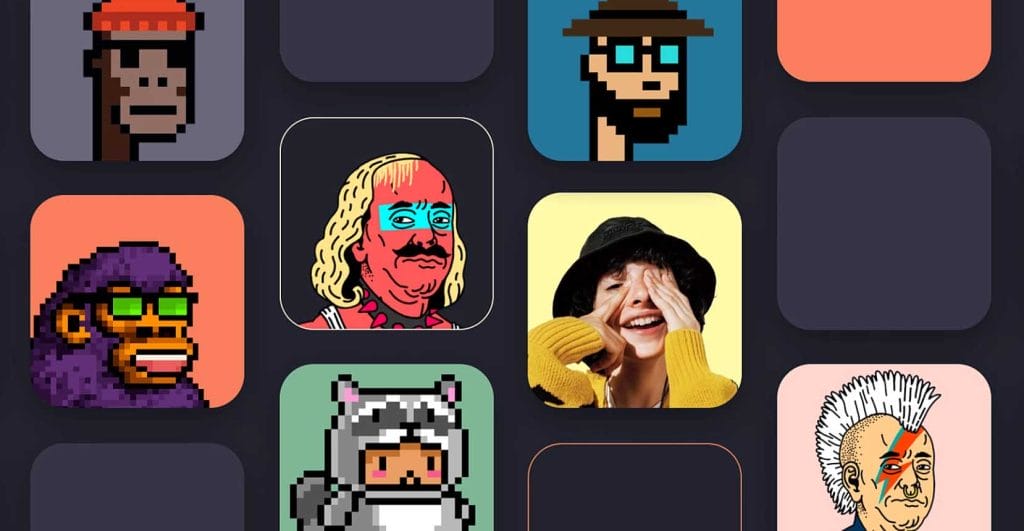

NFT marketplaces have become the center of digital creativity in 2024. They bring together artists, collectors, and investors in one virtual space. Each marketplace has unique features, fees, and audiences. With so many options, picking the right platform is crucial. This guide will help you understand how NFT marketplaces work and how to choose the best one for your needs.

What is an NFT Marketplace?

An NFT marketplace is a platform where digital assets, known as NFTs, are traded. These assets can include art, music, videos, virtual items, and collectibles. NFTs are stored on a blockchain, which guarantees their uniqueness and ownership.

Imagine an NFT marketplace, like a virtual art gallery or auction house. You can view, buy, and sell digital pieces. Unlike traditional galleries, though, NFT marketplaces handle all transactions digitally using cryptocurrencies like Ethereum. For example, a digital artist can sell a one-of-a-kind piece to a collector, and the blockchain verifies the purchase.

NFT marketplaces serve many purposes. They help artists reach global audiences. Collectors find rare and unique pieces. Investors explore a fast-growing market. Some marketplaces focus on high-end art, while others cater to gamers or music fans. The digital economy thrives on these platforms, making them a key part of today’s creative landscape.

In 2024, over $30 billion worth of NFTs were traded globally. This growth highlights the increasing importance of these platforms. Artists like Beeple and brands like Adidas have used NFT marketplaces to reach millions of buyers. This trend continues to shape the future of art and commerce.

How Does an NFT Marketplace Work?

NFT marketplaces operate through simple, structured steps. Here’s how they generally work:

- Sign Up: Create an account on the platform.

- Connect a Wallet: Link your digital wallet to enable transactions.

- Browse Listings: Explore the digital assets available.

- Buy or Bid: Purchase directly or participate in an auction.

- Confirm the Transaction: Complete the purchase with cryptocurrency.

For sellers, the process involves listing items with a description, setting a price or auction, and waiting for buyers. Once a buyer makes a purchase, the NFT transfers securely via blockchain. Marketplaces usually charge a fee for these transactions, which can range from 2% to 5% of the sale price.

A great example is the sale of NBA Top Shot highlights. These basketball clips are tokenized as NFTs and sold on a niche platform. Buyers can own a piece of sports history with just a few clicks. Similarly, platforms like OpenSea allow users to trade digital art and collectibles, offering a wide range of assets.

Steps to Buy and Sell NFTs

| Buying an NFT | Selling an NFT |

| Choose a platform that suits your interests. | Create an NFT using digital art or assets. |

| Create an account and connect your wallet. | Select a marketplace to list your item. |

| Add cryptocurrency like Ethereum to your wallet. | Connect your wallet to the platform. |

| Browse NFTs to find your favorite. | Upload your NFT and provide details. |

| Buy instantly or bid in an auction. | Set a price or auction terms. |

| Confirm the transaction and receive the NFT. | Confirm the sale and transfer the NFT to the buyer. |

For example, a digital artist can upload a piece of art to OpenSea, set a price, and sell it to a buyer in Japan. The transaction is instant, and the blockchain ensures the buyer gets authentic ownership.

Role of Wallets and Cryptocurrencies in Transactions

Digital wallets and cryptocurrencies are vital for NFT transactions. Wallets store your NFTs and digital funds securely. Popular wallets include MetaMask, Trust Wallet, and Coinbase Wallet. These wallets support various cryptocurrencies like Ethereum, Solana, and Polygon.

Cryptocurrencies act as the main payment method for NFTs. For instance, if you want to buy an NFT worth 0.5 ETH, you’ll need Ethereum in your wallet. Wallets also enable you to pay gas fees, which are transaction costs on the blockchain.

Here’s a quick comparison of popular wallets:

| Wallet | Supported Cryptocurrencies | Features | Example Use Case |

| MetaMask | Ethereum, Polygon | Easy setup, browser extension, widely compatible | Perfect for trading art NFTs on OpenSea or minting collectibles on Polygon-based platforms. |

| Trust Wallet | Binance Smart Chain, Solana | Multi-chain support, mobile-friendly interface | Ideal for trading gaming NFTs on Binance NFT or purchasing collectibles on Solana-based marketplaces. |

| Coinbase Wallet | Ethereum, Solana | User-friendly, highly secure, integrates with Coinbase exchange | Great for beginners buying digital art on Foundation or trading popular collectibles on Solana platforms. |

| Ledger Live | Ethereum, Bitcoin, Binance Coin | Hardware wallet, top-tier security for large holdings | Best for securely storing high-value NFTs or using with decentralized marketplaces like Rarible. |

| Phantom | Solana only | Dedicated Solana wallet, lightning-fast transactions | Excellent for interacting with Solana-based marketplaces like Magic Eden for NFTs with lower transaction costs. |

Choosing the right wallet depends on the blockchain used by the NFT marketplace.

Types of NFT Marketplaces

Types of NFT Marketplaces

NFT marketplaces can be divided into several categories:

| Type of NFT Marketplace | Description | Examples | Pros | Cons |

| General Marketplaces | Offer a wide range of NFTs across multiple categories. | OpenSea, Binance NFT | Wide variety of assets; large user base. | Can be overwhelming; less specialized content. |

| Niche Marketplaces | Focus on specific themes like sports, gaming, or art. | NBA Top Shot (sports), Axie Infinity (gaming), SuperRare (art) | Specialized content; targeted audience. | Limited variety; smaller user base. |

| Centralized Marketplaces | Operated by a single authority, providing structured environments. | Binance NFT, Nifty Gateway | Enhanced security; user-friendly interfaces. | Less user control; potential for censorship. |

| Decentralized Marketplaces | Peer-to-peer platforms where users have more control over transactions. | Rarible, Foundation | Greater user autonomy; transparency. | Variable security; may require more technical knowledge. |

Each type caters to different users. General marketplaces are ideal for beginners, while niche platforms attract focused collectors. Centralized platforms may offer better security, but decentralized ones provide greater freedom.

General vs. Niche Marketplaces

| Type of NFT Marketplace | Description | Examples | Pros | Cons |

| General Marketplaces | Offer a variety of NFTs across multiple categories. | OpenSea, Binance NFT | Wide selection of NFTs; large and diverse user base; suitable for various assets. | Can overwhelm beginners due to sheer volume; less personalization for niche collectors. |

| Niche Marketplaces | Focus on specific themes like sports, gaming, or art. | NBA Top Shot (sports), Axie Infinity (gaming), SuperRare (art) | Curated and focused content; attracts a specific audience; offers deeper engagement with niche communities. | Limited variety of assets; smaller user base; fewer options for general NFT trading. |

For example, NBA Top Shot specializes in basketball highlights, while OpenSea offers everything from art to virtual real estate.

Centralized vs. Decentralized Marketplaces

| Feature | Centralized Marketplaces | Decentralized Marketplaces |

| Control | Managed by companies, offering structured systems. | User-controlled, with peer-to-peer transactions. |

| Fees | Higher, as platforms charge service fees. | Lower, with minimal or no platform fees. |

| Transparency | Limited, as platforms may not disclose full operations. | Full, with blockchain ensuring clear records. |

| Security | High, with robust measures from centralized authorities. | Variable, depending on user and platform actions. |

| User Experience | Beginner-friendly with guided processes. | Advanced, requiring more technical knowledge. |

| Censorship | Possible, as companies control content. | Rare, as users have more freedom. |

Popular NFT Marketplaces in 2024

In 2024, the NFT marketplace landscape has expanded, offering diverse platforms catering to various interests and needs. Here’s an overview of some prominent NFT marketplaces:

OpenSea

OpenSea remains the largest NFT marketplace, offering a vast array of digital assets, including art, music, and collectibles. It supports multiple blockchains, such as Ethereum and Polygon, providing users with flexibility in their transactions. As of November 2024, OpenSea boasts over 2 million active users monthly, making it a popular choice for both beginners and seasoned collectors. The platform charges a 2.5% fee on sales, which is competitive within the market.

Rarible

Rarible is a decentralized NFT marketplace that empowers users to create, buy, and sell NFTs with ease. Operating on the Ethereum blockchain, Rarible offers a user-friendly experience and features its own governance token, RARI. Users can earn RARI tokens through active participation on the platform, including buying and selling NFTs. Rarible charges a 2.5% fee on sales, aligning with industry standards.

SuperRare

SuperRare focuses on high-quality digital art and operates as a curated marketplace. Artists must undergo an approval process to list their work, ensuring the exclusivity and uniqueness of the pieces available. Operating on the Ethereum blockchain, SuperRare charges a 3% fee on sales. By November 2024, it has become a preferred platform for serious art collectors seeking premium digital artworks.

Foundation

Foundation is a platform that emphasizes the connection between creators and collectors. It operates on the Ethereum blockchain and is known for hosting exclusive art drops and auctions. Foundation charges a 5% fee on sales, and artists receive 10% royalties on secondary sales, providing ongoing benefits to creators.

Nifty Gateway

Nifty Gateway is a centralized platform that collaborates with top artists and brands to release limited-edition NFTs, known as “Nifties.” It supports fiat currency payments, making it accessible to a broader audience. Nifty Gateway charges a 5% fee plus 30 cents on each secondary sale, and artists receive 10% royalties on secondary sales.

Mintable

Mintable is a user-friendly platform that allows users to create, buy, and sell NFTs. It offers both gasless minting options and traditional minting on the Ethereum blockchain. Mintable charges a 2.5% fee on standard items and a 5% fee on gasless items, providing flexibility for creators and collectors.

KnownOrigin

KnownOrigin is a curated NFT marketplace that focuses on digital art. It operates on the Ethereum blockchain and emphasizes quality and originality. KnownOrigin charges a 15% fee on primary sales and a 2.5% fee on secondary sales, with artists receiving 12.5% royalties on secondary sales, supporting ongoing artist compensation.

Comparison Table

| Marketplace | Active Users (Monthly) | Fee Structure | Focus | Blockchain | Token |

| OpenSea | 2 million+ | 2.5% on sales | Variety | Ethereum, Polygon | No |

| Rarible | Not specified | 2.5% on sales | Variety | Ethereum | RARI |

| SuperRare | Not specified | 3% on sales | High-quality art | Ethereum | No |

| Foundation | Not specified | 5% on sales; 10% artist royalties | Art | Ethereum | No |

| Nifty Gateway | Not specified | 5% + 30¢ on secondary sales; 10% artist royalties | Limited-edition drops | Ethereum | No |

| Mintable | Not specified | 2.5% on standard items; 5% on gasless items | Variety | Ethereum | No |

| KnownOrigin | Not specified | 15% on primary sales; 2.5% on secondary sales; 12.5% artist royalties | Digital art | Ethereum | No |

When choosing an NFT marketplace, consider factors such as the type of digital assets offered, fee structures, user experience, and the platform’s focus. Each marketplace provides unique features catering to different preferences and needs within the NFT ecosystem.

How to Choose the Right NFT Marketplace

How to Choose the Right NFT Marketplace

When selecting a marketplace, consider:

| Factor | Description | Example Platform | Why Choose This Platform? |

| Ease of Use | User-friendly platforms save time and effort. | OpenSea | Easy interface, ideal for beginners. |

| Fees | Transaction costs impact profits and budgets. | OpenSea (2.5% fee), SuperRare (3% fee) | OpenSea offers lower fees for general trading, while SuperRare focuses on art. |

| Asset Type | Ensure the platform supports your preferred NFTs. | NBA Top Shot, Foundation | NBA Top Shot is great for sports fans; Foundation is perfect for digital art. |

| Community | Active user bases create engaging and supportive environments. | Rarible | Vibrant community with token rewards (RARI). |

| Security | Strong security protects your assets and transactions. | Nifty Gateway | Centralized platform with robust security. |

| Payment Methods | Check if the marketplace accepts your payment type. | Nifty Gateway (credit cards), OpenSea | Nifty Gateway allows fiat payments; OpenSea supports multiple cryptocurrencies. |

| Royalties | Ongoing income for creators through secondary sales. | Foundation, Rarible | Foundation offers 10% royalties; Rarible rewards activity with RARI tokens. |

| Environmental Impact | Eco-friendly platforms use low-energy blockchains. | Hic et Nunc (Tezos), Rarible (Flow) | Hic et Nunc has a smaller carbon footprint due to Tezos blockchain. |

Expanded Examples:

- Ease of Use: OpenSea’s intuitive design simplifies trading for beginners. Its filters help users find specific NFTs quickly, making it accessible for everyone.

- Fees: OpenSea charges 2.5% on sales, while SuperRare takes 3%. For high-value art, SuperRare justifies its higher fees with curated collections.

- Asset Type: NBA Top Shot focuses on basketball collectibles, offering officially licensed moments. Meanwhile, Foundation specializes in digital art and exclusive drops.

- Community: Rarible’s user engagement stands out with token rewards for active participants, fostering a sense of ownership and involvement.

- Security: Nifty Gateway protects users by offering centralized control over transactions, ensuring safe trades and asset storage.

- Payment Methods: Nifty Gateway supports credit cards, making it beginner-friendly. In contrast, OpenSea requires cryptocurrencies, appealing to crypto-savvy users.

- Royalties: Foundation ensures creators earn 10% royalties on secondary sales, offering a steady revenue stream. This attracts artists looking for long-term earnings.

- Environmental Impact: Hic et Nunc uses the Tezos blockchain, known for its energy efficiency. This appeals to environmentally conscious traders and creators.

Future Trends in NFT Marketplaces

NFT marketplaces are changing fast in 2024. New trends are making them better. Let’s look at some big changes.

Metaverse Integration

NFT platforms now connect with virtual worlds. This means you can use NFTs in games and online spaces. For example, Decentraland lets you buy virtual land as NFTs. In November 2024, over 500,000 users joined Decentraland. This shows how popular virtual worlds are becoming.

Eco-Friendly NFTs

People care about the environment. Some blockchains use a lot of energy. Now, green blockchains like Flow are popular. They use less energy. In 2024, Flow’s energy use is 0.18 GWh per year. This is much lower than other blockchains. More artists choose eco-friendly options.

AI Integration

Smart tools help users find NFTs they like. AI suggests art based on your taste. For example, platforms use AI to show NFTs you might enjoy. This makes finding art easier. In 2024, 60% of users say AI helps them discover new NFTs.

Fractional Ownership

Some NFTs are very expensive. Now, you can own a part of an NFT. This is called fractional ownership. It lets more people invest. For example, a digital artwork sold for $1 million. With fractional ownership, 1,000 people can each own a piece for $1,000. This trend is growing in 2024.

Cross-Chain Compatibility

Different blockchains don’t always work together. Now, some platforms let NFTs move between blockchains. This is called cross-chain compatibility. It gives users more choices. For example, you can buy an NFT on Ethereum and sell it on Flow. In 2024, 30% of marketplaces support cross-chain NFTs.

Enhanced Security

Security is important for NFT users. Platforms now use better technology to protect assets. For example, two-factor authentication adds extra safety. In 2024, 80% of platforms offer advanced security features. This helps users feel safe when trading.

These trends make NFT marketplaces more fun and safe. They help more people join and enjoy digital art. As technology grows, NFT trading will keep getting better.